Supercharge your financial future with Sharp CFO™

Welcome to Sharp CFO™, a division of We Do Books™. We offer unparalleled expertise in financial management and strategic planning built on the extensive experience and success of our founder Michael DiSabatino.

Michael DiSabatino has spent years serving as a Chief Financial Officer for numerous companies, in addition to his work as a Certified Public Accountant and his own ventures as a business owner.

This unique blend of experiences enables us to provide comprehensive and insightful financial solutions tailored to businesses of all sizes and needs.

Supercharge your financial future with Sharp CFO™

Welcome to Sharp CFO™, a division of We Do Books™. We offer unparalleled expertise in financial management and strategic planning built on the extensive experience and success of our founder Michael DiSabatino.

Michael DiSabatino has spent years serving as a Chief Financial Officer for numerous companies, in addition to his work as a Certified Public Accountant and his own ventures as a business owner.

This unique blend of experiences enables us to provide comprehensive and insightful financial solutions tailored to businesses of all sizes and needs.

A disciplined Sharp CFO™ formula delivers unmatched results!

Races aren’t won at the green flag — they’re won in the preparation, the split-second decisions, and the discipline to manage risk at full throttle. That same mindset separates winning businesses from the rest.

If you’re done cruising and ready to compete at championship level, it’s time to bring a professional race-team mentality to your finances.

Strap in. Let’s build a financial engine made to dominate.

Schedule Your Free Consultation |

Supercharge your financial success with Sharp CFO™Welcome to Sharp CFO™, a division of We Do Books™. We offer unparalleled expertise in financial management and strategic planning built on the extensive experience and success of our founder Michael DiSabatino. Michael DiSabatino has spent years serving as a Chief Financial Officer for numerous companies, in addition to his work as a Certified Public Accountant and his own ventures as a business owner. This unique blend of experiences enables us to provide comprehensive and insightful financial solutions tailored to businesses of all sizes and needs. Contact us today for a free consultation to explore your options and start building a stronger financial strategy. (855) 922-9336 | |

"I've spent years racing motorcycles and cars which trained me for the same split-second focus and high-octane discipline needed to assist you."

Do you have a plan for the road ahead?

Whether you want to retire after a sale, provide a strong company to the next generation, or maintain a company that supports the lifestyle you desire, knowing your goals and keeping them in focus will help you achieve the desired results.

If you think of your business as a race to success, think of Sharp CFO™ as your financial pit crew.

We can map out the most direct route to your fiscal finish line, fine-tune your operations for optimal performance, and help you navigate your course to find the fastest and most efficient path to sustained growth.

Learn more about our services today and let's create an action plan specifically tailored to fit the needs of your business.

Our Winning Services

What do we do?

We are dedicated to driving your business’s financial success through precise planning, robust risk management, and innovative growth strategies. Our approach is grounded in integrity and a deep commitment to your financial health, ensuring that your business not only thrives but also achieves sustained profitability.

Whether you require some or all of our expert financial advice, strategic business planning, asset protection, or detailed accounting services, Sharp CFO™ is here to support and guide you every step of the way.

How can we help?

We understand the unique challenges that small businesses face. That's why we offer flexible, part-time CFO services designed to fit your budget while delivering the same level of expertise and strategic insight as a full-time CFO.

Our goal is to provide high-quality financial guidance and support without the overhead costs, making it easier for your business to thrive.

Financial Planning and Analysis

We craft detailed financial plans tailored to your business that provide a clear picture of your financial health.

For businesses needing a turnaround, we enable you to make informed strategic decisions and get back on track.

With healthy companies, we ensure continued alignment with long-term goals while fostering sustained growth.

Cash Flow Management

We monitor and optimize your cash flow to maintain financial health.

For businesses in recovery, this ensures smooth day-to-day operations and helps stabilize finances.

With healthy companies, it supports ongoing efficiency and effective management of resources.

Budget and Forecasting

You can be ready for tomorrow through realistic budgets and forecasts that enable efficient resource management.

Sharp CFO™ helps struggling businesses plan confidently for recovery and prepare for future growth, while ensuring healthy companies remain on the right track and empower them to capitalize on new opportunities.

SWOT Analysis and Strategic Consulting

We utilize the leverage of SWOT analysis to find a partner's strengths, weaknesses, opportunities, and threats.

Through our actionable advice, we can improve your operations, reduce costs, and boost profitability.

This essential practice can turn around a struggling business, optimize performance, and maintain a healthy company.

Risk Management and Asset Protection

Don't lose it, now that you have it! Our team identifies and mitigates financial risks to safeguard your assets.

Businesses facing challenges can incur complex situations, and this ensures long-term stability and satisfys your peace of mind.

If your company is healthy, we can maintain its financial security and prepare you for unforeseen challenges.

Financial Reporting

Don't put yourself in a position of merely reacting to bad news. Utilize effective tax planning to retain more of what you earn.

We provide detailed financial reporting assistance to keep you informed with accurate records. This helps identify critical financial issues, enabling effective decision-making for businesses in need of a turnaround.

Additionally, for successful companies, it ensures proper tax planning through continued transparency and informed strategic planning.

Our Winning Services

What do we do?

We are dedicated to driving your business’s financial success through precise planning, robust risk management, and innovative growth strategies. Our approach is grounded in integrity….

How can we help?

Whether you need a full pit-lane overhaul or just a quick tune-up, Sharp CFO™ delivers flexible, part-time CFO services that pack the horsepower of a full-time executive—without the team’s payroll. We slot seamlessly into your crew to:

- Map your race strategy with budgeting, forecasting, and FP&A

- Reinforce your roll cage through asset protection and compliance

- Optimize pit-stop performance via cash-flow management and risk mitigation

- Accelerate growth with strategic consulting and financial reporting

All at a fraction of the cost of a full-time hire—so you get championship-caliber expertise on your budget and stay firmly in pole position.

Financial Planning and Analysis

We’re your race-team telemetry center—collecting every sensor reading (KPIs, budgets, cash flows) and turning raw data into split-second strategy calls.

For businesses staging a comeback, we analyze your lap times (expense ratios), tire wear (asset utilization) and fuel consumption (working capital) to pinpoint where you’re losing time—and implement targeted pit stops that get you back on the podium.

For healthy companies, we model the optimal racing lines toward long-term goals—fine-tuning your throttle (investment cadence), mapping out pit-stop timing (cash reserves), and stress-testing your engine (scenario analysis) so you can lead every lap, season after season.

For high-net-worth individuals and families, our telemetry extends to your personal Grand Prix—tracking income streams, expense curves, and legacy objectives so you hit every retirement checkpoint, education milestone, and estate-planning apex with precision.

Cash Flow Management

Running out of cash is like running out of fuel mid-lap—crippling. At Sharp CFO™, we act as your pit crew to monitor your fuel gauge (cash inflows and outflows) and keep your financial engine firing on all cylinders.

For businesses in recovery, we orchestrate strategic pit stops—timely working-capital infusions and optimized payables/receivables that prevent stalls and keep operations rolling smoothly.

For high-net-worth individuals and families, we calibrate your personal fuel reservoir—smoothing income streams, managing expense curves, and fueling your generational goals so you and your heirs can cross every finish line with confidence.

For thriving companies, we fine-tune your fuel efficiency—reallocating surplus cash toward growth initiatives, debt reduction, or reserve buffers so you can maintain pole position in your market.

Budget and Forecasting

Your financial circuit—whether it’s your company’s P&L or your personal portfolio—becomes crystal clear with the right map and pace notes. At Sharp CFO™, we chart your course with detailed budgets (track map) and dynamic forecasts (pace notes) so you know exactly when to accelerate, when to pit, and where the chicanes lie.

For businesses in recovery, we highlight the fastest racing lines to profitability—fueling your comeback drive with confidence.

For high-net-worth individuals and families, we plan your financial Grand Prix—timing investment turns, setting retirement checkpoints, and anticipating tax curves so you cross your personal finish line in style.

For healthy companies, we keep you on your optimal lap time, ready to seize every emerging straightaway and avoid unseen hazards.

SWOT Analysis and Strategic Consulting

We kick off every engagement with a pre-race track walk—our detailed SWOT Analysis maps your horsepower (strengths), engine quirks (weaknesses), open straights (opportunities), and potential chicanes (threats).

Armed with that race intelligence, our pit-crew consultants fine-tune your operations, shed excess weight, and optimize every pit stop—cutting costs and accelerating your path to profit.

Whether you’re staging a comeback drive or defending pole position, this race-ready approach ensures your business engine runs at peak performance, lap after lap.

Risk Management and Asset Protection

Don’t let unexpected hazards take you out of the race. Think of us as your pit‐crew strategist—monitoring race conditions, anticipating every curve, and making split-second decisions to fine-tune your financial setup for peak performance.

When businesses tackle tight hairpins, we reinforce your controls and apply strategic braking on risk exposure—preventing costly spin-outs and keeping operations on course.

For individuals and families, we build a roll-cage around your wealth—shielding savings, investments, and estate plans from sudden liability curves so you can accelerate toward your goals with confidence.

Already leading the pack? We stay on standby in the pits—running stress tests, optimizing your safeguards, and ensuring you’re ready for whatever debris the market throws your way.

Financial Reporting

Don’t wait for bad news to catch you off-guard. With proactive financial analysis and targeted tax planning, you can achieve clearer outcomes and retain more of what you earn—whether it’s profit for your company or personal gains in your household.

Our reporting services deliver accurate, timely records that identify critical issues and empower informed decisions—whether you’re steering a business through a turnaround or managing personal investments and retirement strategies.

By maintaining transparency and leveraging forward-looking insights, we optimize tax outcomes, enhance financial stability, and chart a course for sustainable growth for both businesses and individuals.

Case Studies

At Sharp CFO™, our success is measured by the success of our clients. Many of these successes can be directly attributed to the expertise of our founder, Michael DiSabatino, whose hands-on approach has transformed numerous businesses.

While we often highlight our achievements with larger companies, we also dedicate ourselves to supporting even the smallest of businesses. This includes local businesses and service providers who aim to make their operations more profitable, meet financial growth expectations, and secure the best tax solutions and asset protection.

Here are a few examples of how our expertise has made a significant difference for businesses like yours.

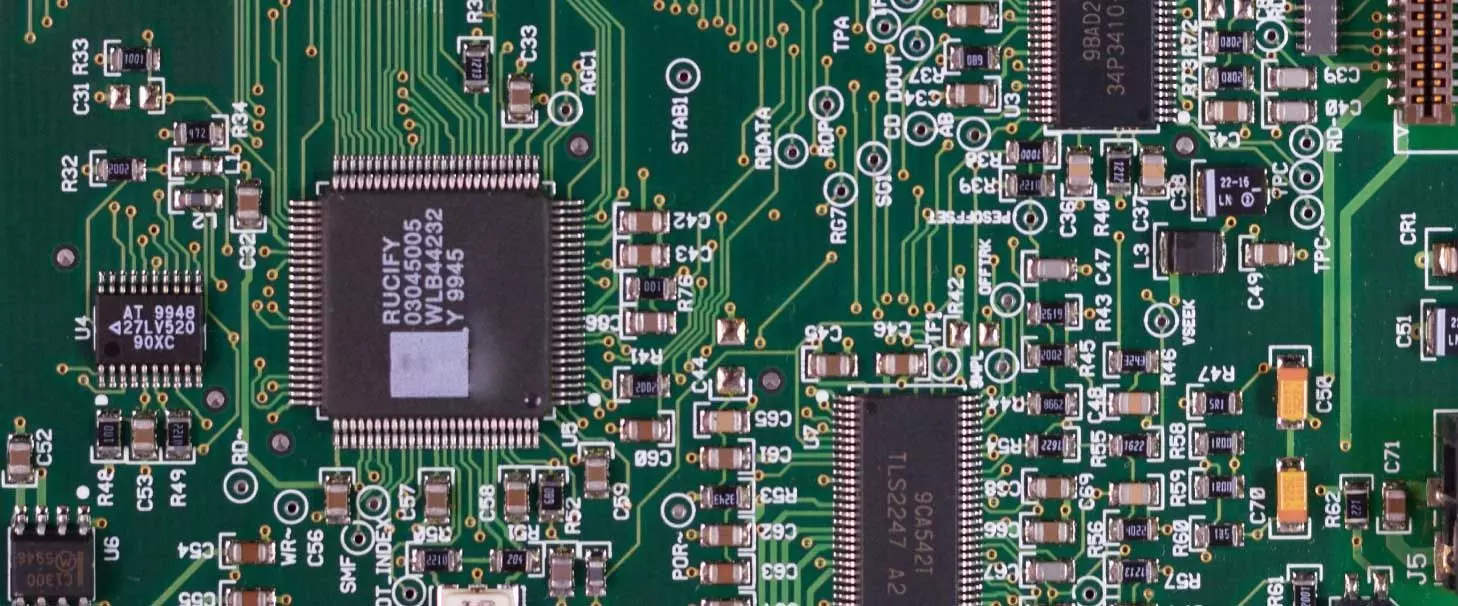

Case Study: Lap of Liquidity

Challenge: An electronics manufacturer needed a $5 million bank loan to smooth cash-flow during expansion—but without organized records or clear projections, lenders stalled.

Pit-Stop: We overhauled their financials, built solid projections, and negotiated directly with the bank—securing the full $5 million infusion.

Finish: Fifteen years (and counting) of continuous part-time CFO support: expansion into two new countries, reduced costs, and sustained profitability.

cdn.sharpcfo.com

Case Study: Pole-Position Growth

Challenge: A small tech startup lacked a scalable financial plan to attract investors and double headcount.

Pit-Stop: We conducted a full SWOT "track walk," mapped growth lines, and built an investor-ready financial model.

Finish: Secured significant venture funding and doubled the workforce, positioning the company firmly at the head of its pack.

Case Study: Safety-Car Retail

Challenge: A family-owned retail business was buffeted by market swings and supply-chain disruptions.

Pit-Stop: Implemented layered asset-protection roll-cages, hedged key exposures, and optimized cash-flow fuel lines.

Finish: Achieved lasting financial stability and resilience—navigating uncertainty with confidence and zero spin-outs.

Case Study: Last-Lap Lifeline

Challenge: A 36-employee machine shop risked missing Friday payroll after falling behind on military contracts.

Pit-Stop: On a Tuesday call, we secured bridge funding, restructured payables/receivables, and realigned expense "tire wear."

Finish: Returned to profitability within months, netting $600 K in Year 1 and $1–2 M+ annually in Years 2–3.

Case Study: Checkered-Flag Exit

Challenge: A performance-auto manufacturer was hemorrhaging $50 K/month and the owner resisted change—even as profitability slipped away.

Pit-Stop: Developed a rapid-exit strategy, refocused leadership on profit lines, and accelerated timeline when the owner’s health prognosis shifted urgency.

Finish: Turned an 80% loss into $1 M profit in Year 1, +50% more Year 2, then sold the business for $10 M cash (no holdbacks) in Year 3—securing the owner’s retirement.

Case Study: Endurance Circuit

Challenge: A 100-person law firm featured in Forbes needed decade-long strategic guidance to manage partner-level decisions and complex cash flows.

Pit-Stop: We provided ongoing “telemetry lab” FP&A, tax-planning pit stops, and capital-management fueling—always just a phone call away.

Finish: Ten years of continuous, part-time CFO support that sustained growth, preserved reputation, and optimized partner earnings.

Case Study: Profit Acceleration

Challenge: A mid-sized manufacturer faced declining margins despite steady sales.

Pit-Stop: Conducted deep-dive telemetry (cost-segregation, process optimization) and overhauled their budget forecast.

Finish: Boosted profit margins by 15% in six months, turning steady sales into accelerating returns.

Case Study: Ground-Up Rally

Challenge: A power-sports superstore spent $3 M on a new facility but lacked asset protection and construction-loan readiness.

Pit-Stop: Laid an asset-protection foundation (multiple LLCs), built lender-friendly projections, and applied cost-segregation depreciation.

Finish: Improved early-year cash flow, accelerated debt pay-down, and sustained a six-year growth run before handing off to an in-house controller.

Case Studies

At Sharp CFO™, our success is measured by the success of our clients. Many of these successes can be directly attributed to the expertise of our founder, Michael DiSabatino, whose hands-on approach has transformed numerous businesses.

While we often highlight our achievements with larger companies, we also dedicate ourselves to supporting even the smallest of businesses. This includes local businesses and service providers who aim to make their operations more profitable, meet financial growth expectations, and secure the best tax solutions and asset protection.

Here are a few examples of how our expertise has made a significant difference for businesses like yours.

Case Study: Lap of Liquidity

Challenge: An electronics manufacturer needed a $5 million bank loan to smooth cash-flow during expansion—but without organized records or clear projections, lenders stalled.

Pit-Stop: We overhauled their financials, built solid projections, and negotiated directly with the bank—securing the full $5 million infusion.

Finish: Fifteen years (and counting) of continuous part-time CFO support: expansion into two new countries, reduced costs, and sustained profitability.

Case Study: Pole-Position Growth

Challenge: A small tech startup lacked a scalable financial plan to attract investors and double headcount.

Pit-Stop: We conducted a full SWOT “track walk,” mapped growth lines, and built an investor-ready financial model.

Finish: Secured significant venture funding and doubled the workforce, positioning the company firmly at the head of its pack.

Case Study: Safety-Car Retail

Challenge: A family-owned retail business was buffeted by market swings and supply-chain disruptions.

Pit-Stop: Implemented layered asset-protection roll-cages, hedged key exposures, and optimized cash-flow fuel lines.

Finish: Achieved lasting financial stability and resilience—navigating uncertainty with confidence and zero spin-outs.

Case Study: Last-Lap Lifeline

Challenge: A 36-employee machine shop risked missing Friday payroll after falling behind on military contracts.

Pit-Stop: On a Tuesday call, we secured bridge funding, restructured payables/receivables, and realigned expense "tire wear."

Finish: Returned to profitability within months, netting $600 K in Year 1 and $1–2 M+ annually in Years 2–3.

Case Study: Checkered-Flag Exit

Challenge: A performance-auto manufacturer was hemorrhaging $50 K/month and the owner resisted change—even as profitability slipped away.

Pit-Stop: Developed a rapid-exit strategy, refocused leadership on profit lines, and accelerated timeline when the owner’s health prognosis shifted urgency.

Finish: Turned an 80% loss into $1 M profit in Year 1, +50% more Year 2, then sold the business for $10 M cash (no holdbacks) in Year 3—securing the owner’s retirement.

Case Study: Endurance Circuit

Challenge: A 100-person law firm featured in Forbes needed decade-long strategic guidance to manage partner-level decisions and complex cash flows.

Pit-Stop: We provided ongoing “telemetry lab” FP&A, tax-planning pit stops, and capital-management fueling—always just a phone call away.

Finish: Ten years of continuous, part-time CFO support that sustained growth, preserved reputation, and optimized partner earnings.

Case Study: Profit Acceleration

Challenge: A mid-sized manufacturer faced declining margins despite steady sales.

Pit-Stop: Conducted deep-dive telemetry (cost-segregation, process optimization) and overhauled their budget forecast.

Finish: Boosted profit margins by 15% in six months, turning steady sales into accelerating returns.

Case Study: Ground-Up Rally

Challenge: A power-sports superstore spent $3 M on a new facility but lacked asset protection and construction-loan readiness.

Pit-Stop: Laid an asset-protection foundation (multiple LLCs), built lender-friendly projections, and applied cost-segregation depreciation.

Finish: Improved early-year cash flow, accelerated debt pay-down, and sustained a six-year growth run before handing off to an in-house controller.

Contact Us

Sharp CFO™

A division of We Do Books, Inc.

Serving the entire United States

581 W. Wickenburg Way, Suite C

Wickenburg, AZ 85390

15333 N Pima Road, Suite 305

Scottsdale, AZ 85260

1000 Town Center Drive, Suite 300

Oxnard, CA 93006

Tele: (855) 922-9336

Sharp CFO (Located in WeDoBooks)

855-922-9336

Sharp CFO - Scottsdale AZ

855-922-9336

Sharp CFO - Oxnard, CA

855-922-9336

Are you ready to shift your business into high gear?

The first step toward financial success is scheduling a consultation with our team. Bring your questions and concerns to our attention. Our engines are revved and ready to drive your business across the finish line as the champion of your industry!

Are you ready to shift your business into high gear?

The first step toward financial success is scheduling a consultation with our team. Bring your questions and concerns to our attention. Our engines are revved and ready to drive your business across the finish line as the champion of your industry!

Book your free consultation today and discover how our services can support your economic growth and long-term financial stability.

(855) 922-9336 |